Preface

While the left has had little success in developing a critique of capitalist value capable of informing either radical organizing strategies or an anti-capitalist narrative which reaches a popular audience, the conventional assumption that manifestations of economic value are reflections of social utility has escaped critical examination.This essay argues that exploring the roots and subsequent development of capitalist value theory over the course of the nineteenth century reveals a Janus-faced project:on the one hand, the development of a popular narrative which insists upon the “natural” inevitability of the scarcity which both backs value and precludes socialism, and on the other, an esoteric discussion of the need to channel the labor-power of society in directions that maintain the scarcity of the goods for which the majority exchange their time.Both the popular and the esoteric discussion had as their common enemy the nineteenth century socialists who argued that both the folly of capitalism and the potential of socialism could be readily seen, and explained, by way of a critical examination of the uses to which the collective labor-power of society were being put.What follows is intended to suggest the contemporary relevance of such an approach as radicals seek to develop narratives about imagined possibilities—which the discourses of value, both popular and esoteric, are deliberately designed to foreclose.

Introduction

The anti-capitalist left is in need of a coherent, popularly accessible critique of capitalist value.We live in a time in which well-researched exposés of capitalist crimes are common—think Monsanto, or the numerous studies that trace everyday objects to the labor and environmental horror stories at the production end of their supply chains—but do little, if anything, to explain the systemic logic that produces the conditions under discussion, much less spark subversive dialogue about possible alternatives to capitalism.Indeed, both elites and the public seem to be held in thrall by a “market populism” that suggests that freedom is found in the marketplace, and “radical” critiques of the systems that produce our food, clothing or electronics frequently conclude by urging us to “revolutionize” the market via a redirection of our purchasing power.

What’s missing, of course, is any critique of the institution of capitalist value, an understanding of which is obviously necessary for any attempt to analyze and explain what drives the allocation of time and resources in our society, or to provide a clear and comprehensible answer to the question, what are we chasing, or being compelled to chase, in this rat race?Being able to answer this question seems crucial to any effort to make a convincing case that the race be scrapped, or to projects animated by a desire to scrap it, or at leastprovide exits and resting points from it along the way.

Value theory is implicit in any attempt to explain the rat race.We’re familiar with the conventional wisdom.Money is the measure of value, and we express our own desires when we part with it, while fulfillingor attempting to fulfill, those of others as we chase it.In aggregate, this is the market, a map of our collective desires, and everyone knows, or is supposed to know, that it would be impossible to imagine a more efficient mechanism for channeling resources in what amounts to a non-stop process of voting on the market to inform the collectivity of our individual wants and needs.Calling it a rat race betrays a bad attitude, though if the characterization happens to be on target, it’s only because, at the end of the day, we are, by our very nature, all rats.

Marxist value theory, of course, is supposed to make short work of this nonsense.Marx tells us that value is the necessary labor-time embodied in the products and services that produce profit for capitalists, and thus serves capital in its inexorable drive for expansion.Workers are exploited in the capitalist production process because the time they spend producing the value equivalent of their subsistence, which they receive in wages, is exceeded by the time they spend working for the capitalist.This is the source of capitalist profit, which is the same thing as the exploitation of labor, and Marx’s value theory makes it possible to read capitalism as the insanity of a society that devotes its time to the pursuit of representations of that very time.

It’s all very heady, seemingly quite powerful stuff.Why, then, is there an apparent disconnect between Marxist value theory and a popular critique of the rat race capable of not just doing battle with, but destroying the banalities of someone like Thomas Friedman?Why is it so hard to draw direct connections between Marx’s account of capitalist value and political projects that inspire us with their potential for transformative change?

Perhaps it’s because by the time we get finished explaining (or attempting to explain) the discrepancy between the value embodied in an iPhone, measured in units of necessary labor time, and its price, the audience has left the room, and they’ve done so not simply because of the obscurity of the discussion, but because it has seemingly taken them so far afield from the concerns that brought them to the discussion in the first place.There is, undoubtedly, a solution to this problem, to be had if only we arrive at the correct reading and presentation of Capital, but I’d like to suggest an alternative route to a subversive critique of capitalist value, one that just might be capable of reaching and engaging a broad popular audience, and serve as a complement to, rather than replacement for, what we’ve learned about capitalism from Marx.

If we can think about political economy as a discourse of governance, not as a contest to see who can come up with the manual which most accurately describes “how the economy works,” it should be obvious enough that as radicals we should take a vital interest in the conception, or conceptions, of value which inform the projects of governance which are inscribed in our landscapes and do so much to structure our lives.In Capital, Marx did just that by taking the economic categories of David Ricardo, the then-reigning champion of bourgeois economics, and demonstrating that they exploded on their own assumptions.The principles of Ricardian economics have long since been decisively rejected by elites, however, specifically on the grounds of their uselessness for the development of tools of governance, with Keynes declaring that the teaching of Ricardo and his followers “is misleading and disastrous if we try to apply it to the facts of experience” (Keynes 1936).In what follows I’ll explore the history and implications of the value theory which triumphed over Ricardo’s precisely for its perceived superiority as a tool of governance, and argue that a plain-spoken indictment of capitalism as a colossal misapplication of time and resources, which has as its intention and effect the exchange of lifetimes of obedience for goods which require comparatively infinitesimal quantities of human labor for their production, can be derived directly from bourgeois value theory itself.

In rejecting the Ricardian conception that capitalist value is embodied labor time, Keynes embraced an alternative definition, that of Thomas Malthus, which defined capitalist value not as the quantity of labor embodied in a particular good, but rather the quantity of labor a good is capable of commanding.The implications of viewing the underlying logic of capitalism in this way are significant, but the historical context out of which the theory came is equally so.We’re familiar with Malthus, of course, not for his theory of value but for his theory of population.Entirely forgotten is that the Essay on Population was both written and used to stifle a radical critique of the channeling of human effort in British society, and it’s necessary to briefly examine it, because it represents the antithesis of the value theory of Malthus and Keynes.

Coming from the pen of William Godwin, the argument went that the scarcity which compelled lifetimes of obedience in exchange for mere subsistence was entirely artificial, the product of a system of private property which had as its essence the restriction of access to the land and tools with which the wants and needs of the community could be produced in abundance.The resulting compulsion to toil away at tasks and projects which contributed nothing to the fulfillment of one’s own desires was the essence of injustice, they argued.Their innovation, however, was to consider the macro-implications of such a system of exploitation.Dividing the population into those engaged in producing the subsistence needs of the nation, and those whose efforts produced nothing for which the majority exchanged their time, the radicals argued that the staggering quantity of human effort consumed by activity in the latter category made clear that the mass poverty surrounding them was no more than a society-wide demonstration of the truth of the age-old adage, “you reap what you sow.”The scarcity that compelled obedience, they argued, was in fact a product of that obedience itself.Given the productivity of human labor, a conscious redirection of social effort was all that was needed to usher in a society of comfort, cooperation, and leisure.

The story of capitalist value reveals it as the antithesis of this vision, at levels both popular and esoteric. The ideological response to the radicals came in the form of Thomas Malthus’s Essay on Population (1798), which provided a popularly broadcast assurance that the scarcity of the means of subsistence was natural and permanent, and would only be exacerbated by any attempt to cheat Nature by increasing the quantity of social effort devoted to their production. Malthus’s insistence that the roots of poverty could be traced to the soils, rather than the institutions of society, was then incorporated at the foundations of the economic system of David Ricardo, which was to dominate the “science” of political economy, in the English-speaking world, for the better part of the nineteenth century.Ricardo made Nature the sole source of the scarcity which conferred value on goods (Ricardo 1973).Goods were scarce, and hence valuable, he argued, to the extent that they were difficult to produce, or pry from Nature’s hands.This difficulty could be measured by the quantity of labor time required for production, and Ricardo made this his definition and measurement of value.

By this definition, as the quantity of labor-time engaged in the production of goods for the market increased, the value of those goods should only go up—Ricardo’s theory denied the possibility of a value-destroying general glut of overproduction.Such a state of affairs, however, was precisely what political economy would be asked to explain, and Ricardian value theory, based on a set of assumptions that did its best work in the service of anti-socialist propaganda, was ultimately rejected as having little correspondence with reality.Ironically, it was Malthus himself who pioneered the attempt to place value theory on a more realistic footing.Value, he argued, was not determined by the quantity of labor required to produce a good, but rather the quantity of labor a good could command in exchange.Profit was the difference between the two categories, i.e., profit is maximized to the extent that the quantity of work required to produce goods is exceeded by the quantity of work required to obtain them.

The macro-implications of Malthus’s “value vision” mirrored what the radicals portrayed as a colossal misapplication of human effort:a dynamic capitalism required a large, and growing, class of “unproductive consumers” to maintain a profitable ratio between the quantity of labor expended in production and that which it commanded in exchange. Malthus’s “value,” or “commanded labor,” was nothing other than the radicals’ “servile dependence,” and when he wasn’t battling socialism, it turns out that he wasn’t even Malthusian:the value of goods, reflected in prices, was not determined by the state of the soils, or difficulty of production, but rather by a proper “proportioning” of effort in society, such that the quantity of labor engaged in the production of goods for the market always set a much larger quantity of labor in motion in exchange for it.This was a “political and moral” project, said Malthus (Malthus 1968, 1), and not a matter of mathematics.

Unlike Ricardo, Malthus was capable of explaining and offering a remedy for capitalist crisis.If we consider Malthus’s definition of profit as a fraction, with the quantity of labor-power offered in exchange for goods on the market as the numerator,[1] and that engaged in the production of goods as the denominator, it’s clear that the rate of profit declines if capitalists continue to increase investment in the production of goods for the market absent any simultaneous increase in the quantity of labor to be exchanged for them.This is how Malthus explained the crisis which followed the end of the Napoleonic Wars:the sudden shift of soldiers and others from the numerator of war-related consumption to the denominator of production for the market increased the quantity of goods on the market at the same time that the quantity of labor exchanging for those goods declined.Contrary to the conventional wisdom, which held that economic growth resulted from capitalist saving, i.e., adding to the denominator, Malthus argued that opportunities for profitable saving resulted from additions to the numerator, in the form of workers whose efforts produced nothing for which anyone exchanged their time.This was why war always resulted in a boom.Despite the nearly religious reverence with which “saving” was held in the field of economic thought, Malthus argued that excessive saving, i.e., increasing the quantity of labor devoted to producing goods for the market, absent any increase in the quantity of labor that would exchange for them, not only led to disaster, but was the essence of capitalist crisis.

The value story is the story of Malthus’s triumph.For while Ricardo’s contentions, that scarcity is rooted in Nature, and that omniscient “market forces” optimize the aggregate channeling of effort in society, were ideally suited as intellectual antidotes to the radical challenge, the three decades of economic depression that marked the end of the nineteenth century resulted in an elite consensus that ongoing revolutions in the productivity of labor threatened to destroy value, if not subjected to regulatory controls.Ricardo’s contention, which Malthus had disputed, that capitalists brought goods to market for the sole purpose of exchanging them with other goods they desired to consume, was no longer given serious consideration, and it was recognized that the “grand prize” of the capitalist game was what Malthus called “leisure with dignity” (Malthus 1968, 216), i.e., an ongoing claim on a portion of the aggregate labor-power of society.Value, then, was not yesterday’s labor congealed in today’s goods, but the obedience today’s production would compel tomorrow.

This conception of value found expression in the “marginalist revolution” within the realm of economic theory, which found value not in the world of production, but rather at the intersections of scarcity and desire, measured in terms of the intensity of effort required to meet one’s perceived needs.In Principles of Economics, marginalist pioneer Carl Menger brilliantly fused the popular Malthus of An Essay on the Principle of Population with the esoteric Malthus of Principles of Political Economy, making Malthus’s “scarcity ratio” safe for college textbooks by assuming up front that the scarcity which compels human effort is natural and eternal before arguing that the poverty of unmet needs, and “fear” of losing access to the means of subsistence were crucial spurs to the human effort that is, in fact, the essence of value (Menger 1950).

Late nineteenth century industrial capitalists required little assistance from economic theory to come to the conclusion that, contrary to Ricardo, the demand for goods was not unlimited, and value was not determined by the quantity of labor expended in production.As they successfully pursued strategies of merger and collusion, designed to restrict output and restore the scarcity, and hence value, of their goods, they discovered that a privileged market position—the ability to restrict output and control prices through the elimination of competition—had more value than their tangible assets of land and machinery.These strategies, pursued out of necessity by crisis-driven capitalists, would be justified in the realm of economic theory by a group of influential economists advising the McKinley and Roosevelt Administrations at the turn of the twentieth century.Marrying a marginalist theory of value to an “overproduction” account of the ongoing crisis, they would offer an inverted echo of the early nineteenth century socialists inspired by Godwin, arguing that the scarcity which backed value was impossible to maintain outside of a regulatory framework explicitly designed to place artificial limits on production (Sklar 1987).

This value story is crucial because the value revolution which took place at the turn of the twentieth century, providing the solution to the late nineteenth century crisis by making value the reward for the maintenance of relative scarcities, rather than a compulsion to engage in self-defeating attempts to increase production by competing with rivals on the basis of price, would form the backdrop for contemporaneous efforts to regulate markets in labor and land, also driven by the pursuit of value.The central regulatory lesson of the late nineteenth century crisis was not only that the maintenance of value required the deliberate creation of artificial scarcities, but that these scarcities were to be effected by the exclusion of competitors from markets.When transferred to attempts to regulate early twentieth century land and labor markets, the pursuit of value would be racialized, as those targeted for exclusion would be identified on the basis of skin color and nationality.

The discussion is also crucial because what quickly becomes apparent is that far from being a neutral measuring stick, external to ourselves, value is a reflection of our own obedience, offered up in exchange for tickets which grant access to the goods which meet our wants and needs.While the pursuit of these tickets is often equated with materialism, the irony is that their value, in fact, depends upon limiting the quantity of goods for which they will be exchanged. If we about the overall social impact of the social institution of value, our immediate attention might be drawn to the explicit tension between value and material abundance so central to the story of value, not just in the realm of theory, but in terms of the institutional strategies pursued for the purpose of maintaining the scarcity of goods—i.e., their ability to compel our time and effort – regardless of the facility of their production.This, indeed, is a crucial part of the value story, and deliberate restriction of material output in the face of a world characterized by such crushing material need would certainly require a place in any attempted reckoning of value’s impact on human well-being.But just as the rejection of Ricardo entailed a recognition that the “prize” of capitalism was not goods, but rather the obedience they compelled, perhaps we should consider the possibility that the true cost of value lies not in the restriction of material output required for its protection, but rather in all the things we give up doing—and becoming—by consenting to lives of obedience in exchange for goods which in fact require very little human effort for their production.The true costs of value, in fact, are opportunity costs, and perhaps what makes value so dangerous to us is our apparent inability to even ask whether the institution of value represents a fundamental barrier to individual and social development.Modern capitalist value theory took shape, in fact, out of an attempt to foreclose that very question.

The Radical Challenge

In 1793, with the publication of Enquiry Concerning Political Justice, anarchist William Godwin helped launch a profoundly subversive social conversation in England regarding the proper allocation of the labor power in the society as a whole.[2] Godwin argued that the mass poverty which characterized British society was the result of an egregious misapplication of human effort, and part of what made his critique so dangerous was the ease with which it could be understood:there was a shortage of food, clothing, and shelter for the masses for the simple reason that such a small portion of the total effort of society was channeled in the direction of producing them.The earth was bountiful, said Godwin, and labor was productive—he estimated that the typical peasant produced enough food for twenty (Godwin 1996).Should all the efforts currently channeled in the direction of “unnecessary employments,” such as church, state, and the “manufacture of trinkets and luxuries” for the rich be directed toward the production of necessities, “the necessity for the greater part of the manual industry of mankind would be superseded” (Godwin 1992, 806) and it was possible to imagine a society of universally shared comfort, cooperation, and leisure.

Godwin thus “zoned” the population into two sections—those engaged in the “necessary” labor of producing the subsistence needs of society, and all “unnecessary laborers” supported by the fruit of those efforts, for the purpose of creating a visualization of social labor in aggregate, examining its consequences, and imagining the possibilities associated with channeling it in alternate directions.[3]For Godwin, however, the misdirected social effort of which he spoke was not a matter of poor organization, but rather one of injustice.The essential feature of the system of private property, Godwin argued, is that it blocks the poor from directly accessing the means of subsistence.[4] The first injustice which results is the state of servile dependence in which the poor find themselves in relation to those offering employment, and the second is that they are compelled to labor for the benefit of others. It is, in fact, the command over labor-power itself which is, for Godwin, the true prize offered by this class-bound economic system:“What is misnamed wealth, is merely a power vested in certain individuals by the institutions of society, to compel others to labour for their benefit Godwin 1996, 38).”[5] As more commanded labor means more of this “misnamed wealth,” Godwin concludes that “the object in the present state of society is to multiply labor; in another state it will be to simplify it” (Godwin 1992, 823).

Godwin’s formulation that the “wealth” of the rich was in fact not represented by their possession of tangible goods, but rather their command over society’s labor-power, meant that the poverty of the many, which compelled them to exchange a lifetime of obedience in exchange for subsistence, was the obverse of the “wealth” of the few.He thus sets up a tension between “what has been misnamed wealth,” i.e., the power to compel labor, and the channeling of labor in directions that will produce comfort and leisure for all.The distinction between a society of class exploitation and one of justice could be visualized by imagining the “zones” into which its aggregate labor-power was channeled:in the first case a zone of hyper-exploited workers engaged in producing the subsistence needs of the entire society is dwarfed by one in which workers exchange their time for those subsistence goods, while producing little or nothing for their own benefit, and in the second, all members of society share in the production of its necessities, with the result that everyone’s “share of labour would be light, and [their] portion of leisure would be ample”(Godwin 1996, 132).

Godwin’s framework became that of the nascentnineteenth century socialist movement in England,[6] though his standpoint of speculative, egalitarian ethics gave way to attempts to empirically ground the assertion that only a fraction of society’s effort was of any benefit to the majority.The central message, however, was that as only human labor could produce the necessaries and conveniences to be consumed by society, “wealth is power over the labour of the poor,” and as “the rich can direct their labour in any line they please,” the result is not only the stockpiling of luxuries on one side, but the maintenance of scarcity on the other, on which the continued command over labor depends (Hall 1965, 346–7, emphasis added).Were the poor able to place land and tools in the service of directly fulfilling their material needs, as opposed to obtaining them indirectly, through service on projects that typically produced nothing intended for their own consumption, the means of subsistence would be so plentiful that no one could compel obedience in exchange for them.[7]Indeed, far from portraying capitalism as an orgy of materialist excess, they argued that the maintenance of class relations required artificial limits to production.The productivity of the labor at the disposal of the rich went far beyond the requirements of even the most lavish consumption of luxury, such that “ingenuity has been on the stretch to find out ways in which it may be expended (Godwin 1992, 823),” with the result that vast quantities of labor were endlessly being channeled into “wild projects of calamity, oppression, war and conquest” (Godwin 1992, 33).

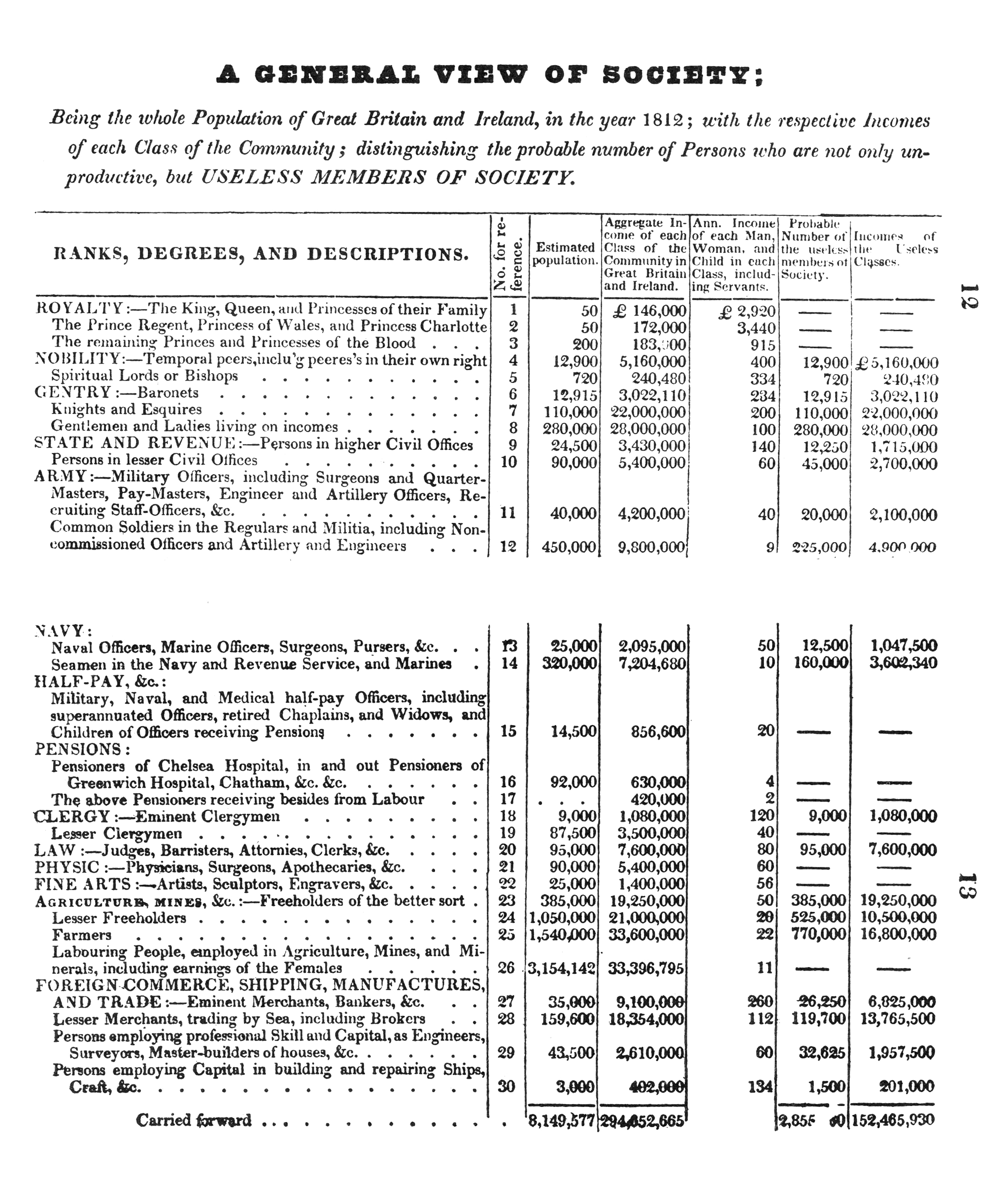

The vast quantities of squandered, “unnecessary” labor in the exploitative present represented the potential wealth of the society of cooperation, and thus creating visualizations of the use of society’s labor-power, in aggregate, was a crucial tool of propaganda, simultaneously acting as both indictment and inspiration.When conservative merchant Patrick Colquhoun undertook an economic census of the British Empire which divided its workers, according to the categories of Adam Smith, into “a productive class whose labor increased the national income and a ‘diminishing class’ which produced ‘no new property’ ” (Briggs, 1985:7), he provided the socialists with “the weapon par excellence for an attack on classical political economy” (Coontz 1966, 60).The socialists used the tables to create what they called a “map of civil society” (Foxwell, in Introduction to Menger 1962), a portrait of social effort in aggregate, for the purpose of awakening subversive imaginations as to the extraordinary potential of their collective labor-power, if channeled in alternate directions.The table provides a numeric breakdown, by class (e.g., royalty, nobility, etc.) or trade, of all those with a claim on the national income, as well as the amount of income accruing to each (see Fig. 1).Using the Smithian logic on which the table was based, i.e., the distinction between “productive” and “unproductive” labor, the socialists were able to argue that not only could it be conservatively estimated that one-third of those drawing an income were “useless members of society,” in terms of making a contribution to the material well-being of the community (Gray 1971, 18), but that these “useless” classes, and the institutions they served, absorbed the lion’s share of the national income.While many of the “productive laborers” listed in the table were undoubtedly engaged in the production of luxuries, they numbered less than half of all income recipients, and received but a fifth of the national income, the remainder being siphoned off in support of “unproductive activity.”The table was “constantly referred to” in the socialist literature of the day (Foxwell in Introduction to Menger 1962, xliii), and became “the statistical foundation of the socialist movement” (Coontz 1965, 62).For the socialists, given the productivity of labor, there was but one conclusion to be drawn from such a “mapping” of the usage of society’s labor-power:

And we think it must be plain to all, that they, who are now supporting themselves in poverty; the middling classes in decency; and the higher classes in luxury; may, by much less labour applied exclusively to their own advantage, surround themselves with every comfort, and forever bid adieu, even to the most distant apprehension of want or poverty; as it is certain that by thus acting, they will not only be gainers of all that is now appropriated to the use of those who do nothing towards the production of that which they consume, but that they will be enabled to removed the greatest of all human errors, the limit of production. (Gray 1971, 58, emphasis in original).

Godwin and his socialist progeny didn’t speak of “economic value,” but their impact on the subsequent nineteenth century value discussion was enormous.The “command over labor” which they referred to as “wealth,” or “misnamed wealth,” would reappear as “value” in later discussions among capitalist economists, along with the same tension posited between this “command over labor” and the “real wealth” of “necessaries and conveniences” so emphasized by these early radicals.Implicit in their analysis was the argument that prices depended on scarcity, but that scarcity, particularly for the crucial items of food, clothes and shelter, had no natural foundation, but rather reflected a distribution of effort in society which, they argued, was the product of class exploitation.[8]This argument would loom large in subsequent attempts to theorize capitalist value.Perhaps most crucially, the socialist practice of “zoning” the population into the categories of those who produce the goods which command labor, and those who work in exchange for those goods, anticipates the subsequent value discussion amongst capitalist economists, who also utilized these categories, though in the service of a social project antithetical to that of the socialists.Most directly, however, these socialists influenced the value discussion by way of the response they elicited, in the form of Malthus’s Essay on Population, as the scarcity assumptions at the heart of his argument would be incorporated at the foundations of Ricardo’s value theory, which would dominate the “science” of economics in the English-speaking world for the better part of the nineteenth century.

Table 1. The socialist “map of civil society.”

Scarcity to the Rescue

British conservatives had a persuasive reply to the Godwin-inspired notion that poverty, and the obedience it compelled, was both cause and consequence of the directions down which the efforts of society were being channeled, and it came in the form of Thomas Malthus’s Essay on Population (1798). Malthus announced Godwin as his target in the opening sentence of the preface, and proceeded to argue that the scarcity thatGodwin traced to the human institution of private property, and the resulting claims it gave on the right to direct the efforts of the entire society, in fact had its roots in “Nature” itself. Malthus’s argument is familiar, of course, though it’s rarely remembered that it was written as a broadside against socialism.His argument is ruthless in its simplistic efficiency, and he requires only a handful of sentences in order to fashion a club with which to beat back the radical challenge:

I think I may fairly make two postulata.First, that food is necessary to the existence of man.Secondly, that the passion between the sexes is necessary and will remain nearly in its present state…Assuming, then, my postulata as granted, I say, that the power of population is indefinitely greater than the power in the earth to produce subsistence for man.Population, when unchecked, increases in a geometrical ratio.Subsistence increases only in an arithmetical ratio.A slight acquaintance with numbers will shew the immensity of the first power in comparison of the second…This implies a strong and constantly operating check on population from the difficulty of subsistence.This difficulty must fall some where [sic] and must necessarily be severely felt by a large portion of mankind…No fancied equality…could remove the pressure of it for even a single century.And it appears, therefore, to be decisive against the possible existence of a society, all the members of which should live in ease, happiness, and comparative leisure; and feel no anxiety about providing the means of subsistence for themselves and their families (Malthus 1996, 4–5).

Scarcity, then, was natural and permanent, and the “close habitations and insufficient food of many of the poor,” along with “war,” and “periodical pestilence or famines” (ibid, 44–45) in fact, were all part of an “imperious all pervading law of nature” designed to restrain population “within the prescribed bounds” (ibid, 5).Not only was it impervious to any radical attempt at a redirection of social effort in the interest of the vast majority, but efforts in such direction, to the extent that they removed the “difficulty of subsistence” which acted as the chief “positive check” to population, would precipitate disaster.Malthus readily acknowledged that channeling social effort in the directions envisioned by Godwin “would tend greatly to augment the produce of the country” (ibid, 65).But therein lay the problem:Were Godwin’s vision actually realized, such that “every house is clean, airy, sufficiently roomy, and in a healthy situation,” “all men are equal,” “and the necessary labours of agriculture are shared amicably among all,” these “extraordinary encouragements to population” would result in a rate of population growth “faster than in any society that has ever yet been known” (ibid, 64–65).Though Malthus begins his essay with the apology that “a long and almost total interruption from very particular business…prevented the Author from giving to the subject an undivided attention” (ibid, 1), he feels confident in estimating that a century-long Godwinian attempt at universal comfort and leisure would result in the population of England mushrooming from 7 to 112 million, with food sufficient for less than a fourth of these.[9] Long before such a state of affairs had ever been reached, Malthus argues, it was almost certain that “an administration of property, not very different from that which prevails in civilized States at present, would be established as the best, though inadequate, remedy, for the evils which were pressing on the society” (ibid, 69).

Not just the poverty of the poor, then, but the property of the rich, were mere manifestations of an “impervious all pervading law of nature.”In less celebrated passages, however, Malthus indicated that comfort for the majority was undesirable regardless of its presumed effects upon population.In considering the effects of an increase in the purchasing power of the poor, Malthus restates, in his own words, the linkage thatGodwin had sought to establish between “the power to compel others to labour” and the poverty of the majority:

The receipt of five shillings a day, instead of eighteen pence, would make every man fancy himself comparatively rich and able to indulge himself in many hours or days of leisure.This would give a strong and immediate check to productive industry, and in a short time, not only the nation would be poorer, but the lower classes themselves would be much more distressed than when they received only eighteen pence a day (ibid, 27).[10]

Malthus was against lessening the compulsion to work, regardless of its impact on population.The intent of the Essay On Population, however, was to naturalize this compulsion, and the class relations which accompanied them, thus rendering moot any subversive speculations as to the human potential that might be achieved were the poor to channel their efforts in directions of their own choosing, and sever the tethers that bound them to people and projects inimical to the fulfillment of their wants and needs.[11]In this, he was enormously successful.Godwin admitted that Malthus’s essay converted many of his own supporters, and the new theory of population, which “scientifically proved” the impossibility of socialism, became the weapon of choice in a “torrent of scurrilous abuse spat [at Godwin] from the pulpit and in the lecture theatre, and smeared across pamphlets, novels and verse” (Marshall, in Godwin, 1985:20).Crucially for the nineteenth century value discussion, Malthusian assumptions regarding the natural permanence of scarcity, and the ineluctable relationship posited between population and resources, were incorporated at the foundation of the new “science” of political economy, and the categories it erected in its attempts to theorize “economic value.” These attempts similarly required an ideological project of “zoning” the population into groups defined by the activities of their members, and the perceived relationship between these activities and the theorized conception of “value.”

Don’t Get High on Your Own Supply

What had proven so effective as an ideological battering ram against Godwin and the socialists, however, proved to be of less obvious merit to the nascent “science” of political economy, which would ultimately be asked to explain glutted markets, rather than predict exhausted soils.David Ricardo, whose economic system would stand supreme in the English-speaking world until the second half of the nineteenth century, placed Malthus’s scarcity assumptions at the heart of his theory of value, and made society out to be a sort of Malthusian wind-up doll, with his key categories of wages, profit and rent all varying in accordance with the extent to which population growth had pushed the pursuit of means of subsistence onto increasingly less fertile ground.

If the Malthusian world was one of human struggle against a stingy earth for the fulfillment of wants and needs, Ricardo’s standard of value was its unit of measurement, as it measured, in quantities of human labor-time, the difficulty with which humanity procured the articles it sought to consume.Ricardo’s was an “embodied labor” theory of value (McCracken 1933, 17), as he argued that the value of a good was determined by the amount of labor required to produce it – literally, by the quantity of human labor-time congealed, or “embodied” within the good itself.As the efficiency of producing a good increased, i.e., as it required less labor-time to produce, its value declined commensurately.Ricardo thus naturalized value, as for him it traced back, not to human institutions and class relations, but to an eternal condition of human struggle against nature, as operative in an “early state” of society featuring exchange of deer and beavers as it was in his own day.Actual market prices did not always reflect values, but they were always headed in their direction, and it was reasonable to assume that the price of a product with ten hours of labor “embodied” in it would be double that of a product produced in half the time (Ricardo 1973).

Ricardo’s value theory, and the theoretical system which it supported, ironically erected an ideological fortress against the socialist challenge while simultaneously presenting an account of the channeling of human effort in capitalism thatmirrored that of his radical contemporaries, down to the most minute details.For while the socialists were busy with their Colquhoun tables, attempting to lift the veil on the forces directing the labor-power of society and expose them as products of exploitative human institutions, the upshot of Ricardo’s theory was that omniscient, omnipotent forces beyond human control had the beneficent effect of putting everyone in their proper place, even if that place was a large and growing “zone” of Godwin’s “unnecessary labor,” producing “trinkets and luxuries” for the rich.

The promise that there was a secular tendency for the productivity of agricultural labor to decline as it was pushed onto less fertile soil foreclosed socialist visions of the “productive powers” that might be unleashed were the artificial “limits to production” required by the system of private property removed, but Ricardo’s theory also precluded the possibility that a fundamental misdirection of effort, manifesting itself in a glut of oversupply, could result from positive revolutions in the productivity of labor.His “embodied labor” theory of value meant that the purchasing power required to purchase the goods on the market was congealed, as value, in those goods themselves, i.e., if all the goods on the market represented 1 million hours of labor, this was also the quantity of labor, or value, required for all the goods on the market to be purchased and the market to clear.To this he added the assumption that there was no other reason to take the trouble to engage in production other than a “view to consume or sell,” and that the producer “never sells but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to further production” (Ricardo 1973, 192).[12] Thus, not only did all the purchasing power required to purchase the goods on the market exactly match the value of those goods (for it was the same thing), but it was also, and always, an exact measurement of the desire to consume, for the shoe manufacturer only brings $1000 worth of shoes to market with the intent of exchanging them for $1000 worth of other goods.It was certainly possible that particular producers would misjudge the market, resulting in a temporary over-or under-supply of certain goods, but this was what the price system was for, and short-term prices which exceeded or fell short of a good’s “natural value” were all that was needed to nudge the efforts of society back in the direction of their optimal deployment.Markets, then, had a built-in tendency to clear, and general gluts of overproduction were impossible (ibid).

As if to render the fortress he’d erected in defense of these “omniscient” forces directing the labor-power of society truly impenetrable, Ricardo added to all this the further assumption that the demand for goods knows no limit, i.e., that there was no need to worry that revolutions in productivity might result in capital without an outlet for profitable production, much less the possibility of workers receiving their means of subsistence in exchange for less working time.The latter concern was dispensed with by the class relations of capitalism.Labor itself was a commodity, with its value determined by the quantity of labor required to produce the goods for which it exchanged its time, i.e., by the proportion of the total number of workers in society laboring in Godwin’s zone of “necessary labor,” producing their means of subsistence.If the quantity of labor required to produce the food, clothes, and shelter consumed by workers declined, the “value” of labor also declined, precisely to that extent, thus reducing the size of labor’s share of the total social product, even as the quantity of goods they consumed remained the same.Such a reduction in the “value” of labor redounded immediately to the benefit of the capitalists, who would always, according to Ricardo’s assumption, set the labor no longer necessary for the production of worker subsistence to work producing luxuries for themselves:

The poor, in order to obtain food, exert themselves to gratify those fancies of the rich; and to obtain it more certainly, they vie with one another in the cheapness and perfection of their work.The number of workmen increases with the increasing quantity of food, or with the growing improvement and cultivation of lands; and as the nature of their business admits of the utmost subdivisions of labours, the quantity of materials they can work up increases in a much greater proportion than their numbers.Hence arises a demand for every sort of material which human invention can employ, either usefully or ornamentally, in building, dress, equipage, or household furniture; for the fossils and minerals contained in the bowels of the earth, the precious metals, and the precious stones (Adam Smith, cited with approval by Ricardo in Ricardo 1973, 197).[13]

This endless appetite for luxury on the part of the rich meant that “no accumulation of capital will permanently lower profits unless there be some permanent cause for the rise of wages” (Ricardo 1973, 192), i.e., the only limit to the profitable deployment of capital for the purpose of the production and consumption of luxuries was “that which bounds our power to maintain the workmen who are to produce them” (ibid, 195).Tragically, however, “that which bounds our power” was none other than Malthus’s iron law of population, which manifested itself in rent.Godwin may have imagined that a single peasant could produce food for twenty people, but there was less fertile land on which he would not be so productive.As population grew, agriculture would be pushed onto this less fertile soil, and this was the source of the landlord’s rent.Since the market price of agricultural goods was determined by the cost of its production on the least fertile soil, a bonus, in the form of rent, accrued to every owner of land more fertile than the worst land that population growth had pushed into cultivation, and rent’s share of the total social product grew along with the difference in fertility between the best and worst lands producing food for the market.[14] Since the cost of food essentially determined the cost of labor, the value of the wage increased along with rent, as it would take an increasing number of workers to produce a given quantity of subsistence, thus reducing the size of the capitalist’s claim on the total social product:“The natural tendency of profits is thus to fall; for, in the progress of society and wealth, the additional quantity of food required is obtained by the sacrifice of more and more labour” (Ricardo 1973, 71).

Perhaps worst of all is that capital brings this state of affairs onto itself.For Ricardo, capital was literally that which set “productive” workers in motion—the means of subsistence thatthey would consume, along with the tools, machinery and materials they would use in producing goods for the market.As capital increased, it required more labor, and when labor was in short supply vis a vis capital’s demand for it, wages would rise, temporarily, above labor’s “natural” subsistence-level price.Capital’s demand for labor would then be satisfied by the increased production of working-class children,[15] who would not only eventually restore the “natural price” of labor by ending the shortage of workers, but also raise rents and reduce profits by increasing population and pushing farmers onto less fertile soil.Thus, capital, population, and rent increased in lock-step together, as Godwin’s peasant, producing food for twenty, was relentlessly pushed in the direction of land on which his efforts would furnish food only for himself.Long before this state was reached, however, “the very low rate of profits will have arrested all accumulation, and almost the whole produce of the country, after paying the labourers, will be the property of the owners of land and the receivers of tithes and taxes” (Ricardo 1973, 71–72).

By incorporating at the heart of his economic theory a dogma that did its best work as the stuff of anti-socialist propaganda, Ricardo reduced the entire trajectory of human history, at least in the “civilized” states, to a twist of the Malthusian knob.Turn it in the direction of facility in the production of means of subsistence, and the efforts of labor were channeled in the direction of Godwin’s “unnecessary labor,” producing luxuries for the rich, while the inevitable turn in the opposite direction required increased effort in the production of subsistence, the decline of profits, and ultimately social stagnation.What would prove problematic for Ricardo’s theory, in terms of its persuasiveness, was not simply that Godwin’s peasant would soon be producing enough food for at least one-hundred, rather than twenty.[16] Even more, it was that precisely by rendering the forces channeling labor-power in capitalist society immune to attack that he also rendered economic theory powerless to explain value-destroying economic crises, which were increasingly associated with revolutions in the productivity of labor and gluts of overproduction.Indeed, even as he wrote in 1817, amidst the depression following the end of the Napoleonic Wars, the iron-clad logic which flowed from his dubious assumptions was at a loss to provide explanations for any scenario other than those in which markets happily cleared, though with a Malthusian clock ticking ominously in the background.Having explained the manner in which prices and profits gently prodded capital down the proper, market-clearing channels, Ricardo takes a short break from his totalizing theory with the comment that:

The present time appears to be one of the exceptions to the justness of this remark.The termination of the war has so deranged the division which before existed of employments in Europe, that every capitalist has not yet found his place in the new division which has now become necessary (Ricardo 1973, 50).

Ricardo’s theory, and the Malthusianism on which it was based, were ideal as an antidote to the socialist challenge, but the “abstract and unreal character of the assumptions on which [it was] founded” rendered it useless as a tool of governance, particularly in the face of economic crisis (Foxwell, Introduction to Menger 1962, xli).[17]His market-clearing assumptions, along with his theory of value, which naturalized the scarcity reflected in prices, would be challenged, and ultimately discarded, at least for practical purposes, in an attempt to place economics on a more realistic footing.

Ironically, it was Malthus himself who pioneered this attack on the Ricardian system, arguing that the scarcity which backed value, and the obedience it compelled, could not be left up to the “imperious all pervading law of nature” with which he had so successfully battled Godwin.Value, rather, was a project of governance, and was to be maintained, not by “Nature,” and the unyielding law of population, but by maintaining, interestingly enough, an adequate “proportion” of none other than “the unproductive laborers of Adam Smith” (Malthus 1968, 406).

When Nature Fails to Cooperate

While the lessons of the Essay on Population were popularized in sermons and story-books aimed at the working class (Marshall, in Godwin 1996, 20–21), Malthus’s Principles of Political Economy (Malthus 1968) reached a far more limited audience.In it, he attacked Ricardo’s mechanistic system arguing that: “the science of political economy bears a nearer resemblance to the science of morals and politics than to that of mathematics” (Malthus 1968, 1).Ricardo, Malthus claimed, had erred in his fundamental assumptions, with the result that his theory offered very little in the way of practical application.[18]Malthus rejected the Ricardian notion that value was determined by “embodied labor-time,” as well as his presumption that demand was infinite, a “doctrine” which, he told him by letter, “flies in the face of all experience” (Ricardo 1951, 326). Ricardo’s presumption of unlimited demand was based on the belief that the end of capitalist production was the consumption of goods, i.e., that capitalists brought goods to market for the purpose of essentially bartering them for goods of equal value.With this, Malthus, argued, Ricardo had misjudged the entire purpose of capitalist production.Capitalists were not producing in order to satisfy an unlimited desire to consume, but rather in order to “save a fortune” (Malthus 1968, 400), i.e., to secure for themselves an ongoing claim on a portion of the aggregate labor-power of society.[19]By severing the Ricardian connection between production and consumption, Malthus not only raised the possibility of a general glut, which Ricardo’s system was bound to deny, but suggested an alternate definition of value, consistent with what capitalists were actually pursuing:a good’s value, he argued, was determined not by the quantity of labor required to produce it, but rather by the quantity of labor which it could command in exchange. Malthus’s alternate conception of value caused him to ground it, not in “nature,” but rather in a proper “proportioning” of the labor engaged in production for the market with the labor that would be exchanged for those goods.With this, he ironically joined the socialists he’d so effectively battled with the Essay on Population by arguing that the scarcity which backs value, and commands human effort, has no natural foundation, but rather is a reflection of the directions in which the aggregate labor-power of society is channeled.

Malthus begins his critique of Ricardo by stating that the “embodied labor” theory of value simply has no basis in reality:

It is not merely what should be the definition and the measure of value in exchange, but a question of fact, whether the labour worked up in commodities either determines or measures the rate at which they exchange with each other; and in no stage of society with we are acquainted does it do this (Malthus 1968, 85).

Ricardo is correct in assuming that it is the difficulty of obtaining a desired good which confers value upon it, says Malthus, but the reason the quantity of labor “embodied” in a commodity never bears any meaningful relation to the rate at which it exchanges with other goods is that there are so many sources of this scarcity besides the labor-time required for production.The mere difficulty of acquiring capital often causes the products of the capital in existence to exchange at a rate far higher than would be expected by Ricardo’s standard of measurement, and “natural and artificial monopolies, and temporary deficiencies of supply” all have the same effect (ibid, 83).Value is increased by “every circumstance which contributes in any degree to enhance the difficulty of obtaining” desired goods (ibid), and as Ricardo’s standard reduces the source of value to one solitary factor, it will always be wide of the mark.

Having thus rejected Ricardo’s definition of value, Malthus argues that the standard of “commanded” labor-time brings the measurement of value into line with what capitalists are actually pursuing.He proposes the price of unskilled manual labor as the unit of measurement, and argues that the value of a good, as well as its rate of exchange with other goods, can be determined by dividing its market price by that of, say, a day’s worth of “common agricultural labour,” in order to determine the quantity of labor which it will command in exchange (ibid, 96).It’s not just that such a method of measurement will reflect a good’s value regardless of whether it stems from Ricardo’s difficulty of production, or any other factor.The unit of “common labour” is crucial because it actually indicates the quantity of human effort that will be given in exchange for a particular good at a given point in time, and this effort is the essence of value itself—a good that compels no effort has no value.The maintenance and enhancement of value depends upon limiting access to the things which people want and need, and anything which serves to do this, not simply difficulty of production, measured by Ricardo’s embodied labor-time, is a source of value.In discussing “the distinction between wealth and value,” Malthus makes this quite clear:

It has been justly stated by Adam Smith that a man is rich or poor according to the degree in which he can afford to enjoy the necessaries, conveniences, and luxuries of human life.And it follows from this definition that, if the bounty of nature furnished all the necessaries, conveniences, and luxuries of life to every inhabitant of a country in the fullest measure of proportion to his wishes, such a country would be in the highest degree wealthy, without possessing any thing which would have exchangeable value, or could command a single hour’s labour (ibid, 299).[20]

Malthus then considers the macro-implications of such a conception of value.He defines “demand” as “the sacrifice which the demanders must make” in order to obtain the desired quantity of a good, a “sacrifice” which, he goes on to argue, is best measured in units of “common labour,” i.e., “demand” is none other than “value” (ibid, 82).What is crucial for capitalists is the extent to which “demand,” reduced to units of “common labor,” exceeds the cost of production, expressed in the same unit of measurement.Put another way, the more labor will exchange for the product of the “productive labor” producing goods for the market, the greater the value of those goods.

For Malthus, this had two crucial implications.The first was that, contrary to Ricardo, a value-destroying excess of capital[21] was not only entirely possible, but in constant danger of actual occurrence.For according to his conception of value, if the quantity of labor engaged in bringing goods to market increases without a simultaneous increase in the quantity of labor that will exchange for it, the rate of profit, determined by “demand” minus “cost of production,” will by definition decline.This, for Malthus, was exactly what had occurred with the end of the Napoleonic Wars, and explained the glut of overproduction that so befuddled Ricardo:as the “demand” of soldiers and others whose efforts on behalf of the war produced nothing for the market became “costs” in the production of goods, the crucial gap between the quantity of labor exchanging for goods and that engaged in their production narrowed to the point of a crisis of profitability.Value was a matter of proportions, and could only be contemplated in terms of the efforts of the society as a whole.[22]“If you were at once to employ all our soldiers, sailors and menial servants in productive labor,” Malthus told Ricardo, “the price of produce would fall more than ten percent, and the encouragement to employ the same quantity of capital would cease” (Ricardo 1951, 168).

The second macro-implication is implicit in the first. Malthus’s conception of value meant that the demand for the product of those workers producing goods for the market could not come from these workers themselves, for their labor-time represented the denominator in the value fraction, the size of which he sought to maximize:

It is indeed most important to observe that no power of consumption on the part of the labouring classes [producing for the market] can ever…alone furnish an encouragement to the employment of capital.No one will ever employ capital merely for the sake of the demand occasioned by those who work for him.Unless they produce an excess of value above what they consume…it is quite obvious that his capital will not be employed in maintaining them…The very existence of a profit upon any commodity presupposes a demand exterior to that of the labour which has produced it (Malthus, 1968, 404–5; the final sentence was written by the editor).

Maximizing the size of this “exterior” demand meant that the number of workers employed in the zone of “productive labor,” producing goods for the market, had to be properly proportioned with those members of the population outside this zone, in order for the goods they produced to have any value.Echoing Godwin’s argument that the productive powers of human labor were so vast that they dwarfed the capacity of the rich to consume luxuries, Malthus similarly argued that an excessive channeling of labor-power into production for the market would “inevitably lead to a supply of commodities beyond what the structure and habits of such a society will permit to be profitably consumed” (ibid, 325).

While Malthus had battled the socialists with promises of famine, he now argued that given “the fertility of the soil,” and “the powers of man to apply machinery as a substitute for labour” (ibid, 398), “there must therefore be a considerable class of persons who have both the will and power to consume more material wealth than they produce, or the mercantile classes could not continue profitably to produce so much more than they consume” (ibid, 400).[23] With this, Malthus zones the non-rich into two distinct categories:the productive laborers producing goods for the market, and the “unproductive consumers” whose chief role, in terms of the value project, was to add to the quantity of labor exchanging for the product of those producing goods for the market, and thus increase “the exchangeable value of the whole produce” (ibid, 398).For Malthus, the two groups form utterly separate classes:

And it is to be further remarked, that all personal services paid voluntarily, whether of a menial or intellectual kind, are essentially distinct from the labour necessary to production.They are paid from revenue, not capital.They have no tendency to increase costs and lower profits.On the contrary, while they leave the cost of production, as far as regards the quantities of labour required to obtain any particular commodities the same as before, they increase profits by occasioning a more brisk demand for material products, as compared with the supply for them (ibid, 408–409).

“Unproductive consumers” could be comfortable, as their level of effort in exchange for a wage is immaterial, with respect to value, and profits aren’t dependent on their low wages.“Productive labourers,” of course, are not so fortunate, and Malthus is heartened by the fact that with ongoing revolutions in productivity, the proportion of the population living off “revenue” can increase relatively to that engaged in productive labor:

Another most desirable benefit belonging to a fertile soil is, that states so endowed are not obliged to pay so much attention to that most distressing and disheartening of all cries of all cries to every man of humanity—the cry of the master manufacturers and merchants for low wages, to enable them to find a market for their exports.If a country can only be rich by running a successful race for low wages, I should be disposed to say at once, perish such riches! (ibid, 214).

While steady increases in productivity can democratize comfort, as soldiers, clerks, and teachers increase in proportion to the workers producing the goods for which they exchange their time, Malthus takes care to emphasize that no wage should ever be so high as to permit withdrawal from the labor market:“And whatever may be the state of the effectual demand for labor, it is obvious that the money price of labor must, on an average, be so proportioned to the price of funds for its maintenance, as to effectuate the desired supply” (ibid, 218).Measured in terms of value, a society in which the masses of people were able to live in comfort by working only two days per week would be a very poor society indeed:“the man who can procure the necessary food for him family, by two days labour in the week, has the physical power of working much longer to procure conveniences and luxuries, than the man who must employ four days in procuring food; but if the facility of getting food creates habits of indolence, this indolence may make him prefer the luxury of doing little or nothing, to the luxury of possessing conveniences and comforts; and in this case, he may devote less time to the working for conveniences and comforts, and may be more scantily provided with them than if he had been obliged to employ more industry in procuring food” (ibid, 336).This state of poverty exists throughout Latin America, he asserts, where “the banana is cultivated with a trifling amount of labor,” while in “the town of Mexico,” the situation is so dire that “the very dregs of the people are, according to Humboldt, able to earn their maintenance by only one or two days labour in the week” (ibid, 339).These problems were institutional, Malthus argued, and while such societies certainly suffered from a dearth of capital, economists were wrong to assume that a mere influx of investment would result in a ready supply of willing laborers.In a society in which the typical commoner’s “wants are few, and these wants he is in the habit of supplying principally at home” (ibid, 349), it is not only necessary for the prices of necessities to be raised to the point that he is “obliged to employ industry in producing food,” but that a willingness to work is effected through the cultivation of a desire to consume “conveniences and luxuries” (ibid, 348). Towards this end, he suggested the cultivation in the poor of a desire for the consumption of “ribands, lace, and velvet” (ibid, 321).

It is ironic that while the Malthus who insisted upon the natural permanence of scarcity earned a word in the dictionary for his efforts, the Malthus of Principles of Political Economy, who argued that the maintenance of scarcity required the erection of a regulatory lightning rod for the productive powers of humanity, is almost entirely unknown.It is not as if the latter Malthus has been without influence.John Maynard Keynes, who took his own ideas for channeling human effort in scarcity-inducing directions directly from Malthus (McCracken 1961), called Malthus’s insistence that an inadequate amount of “unproductive consumption [on the part] of the landlords and the capitalists” was chiefly responsible for the crisis following the Napoleonic Wars “the best economic analysis ever written of the events of 1815–20,” and summarized Malthus’s futile attempts to persuade Ricardo by letter of the crucial role of “unproductive consumption” in the maintenance of value by stating that:

“Time after time in these letters Malthus is talking plain sense, the force of which Ricardo with his head in the clouds wholly fails to comprehend.Time after time a crushing refutation by Malthus is met by a mind so completely closed that Ricardo does not even see what Malthus is saying…If only Malthus, instead of Ricardo, had been the parent stem from which nineteenth-century economics proceeded, what a much wiser and richer place the world would be today!…I have long claimed Robert Malthus as the first of the Cambridge economists; and we can do so, after the publication of these letters [between Malthus and Ricardo] with increased sympathy and admiration. (Keynes 1951, 117–118; 120–121).

The turn toward Malthus, however, would not have to wait until the Depression decade of the 1930s.It would come with the global economic crisis which began in 1873, an economic slump which lasted, with occasional intermission, over a period of nearly 25 years.

If We Only Had a Crop Failure

Malthus would not defeat Ricardo in the realm of theoretical discussion.Rather, it was the “mild but chronic state of depression” which was the predominant state of business in the capitalist world for the last decades of the nineteenth century (Veblen 1932, 184) that would cause economic theory to increasingly abandon the happy, Ricardian postulates that there was no limit to profitable production, and that markets always cleared.Writing in 1889, before the panic and depression of the 1890s, American economist D.A. Wells characterized economic conditions this way:

The existence of a most curious and, in many respects, unprecedented disturbance and depression of trade, commerce, and industry, which, first manifesting itself in a marked degree in 1873, has prevailed with fluctuations up to the present time (1889), is an economic and social phenomenon that has been everywhere recognized.Its most noteworthy peculiarity has been its universality…the maximum of economic disturbance has been experienced in those countries in which the employment of machinery, the efficiency of labor, the cost and the standard of living, and the extent of popular education are the greatest…and the minimum…where the opposite conditions prevail (Wells 1889, 1;3).[24]

Given its dogmas, conventional economic theory was at a loss to explain the ongoing slump, which gave rise to “a greater number of conflicting economical theories than any other occurrence of ancient or modern time…The result, we need hardly say, has not been to raise the reputation of political economy as a science” (The Nation, May, 1879, cited by Wells 1889, 16).A Dutch committee of 1886 located an important cause of the crisis in “the low price of German vinegar,” while in Germany at the same time, partial blame was laid at the feet of the “immigration of Polish Jews” (ibid, 21).The winner of the “Oxford Prize Essay” of 1879 concluded that “the whole world is consuming more than it has produced, and is consequently in a state of impoverishment, and can not buy our wares” (ibid, 22).

As the slump persisted, however, its source was increasingly identified as “industrial overproduction.”[25]The excess was not in terms of the number “of useful or desirable commodities in excess of what is wanted” for human consumption, but rather, “an excess of demand at remunerative prices, or, what is substantially the same thing, an excess capacity for production” (ibid, 25–26).This, of course, was what Malthus had referred to as “a supply of commodities beyond what the structure and habits of such a society will permit to be profitably consumed” (Malthus 1968, 325), and what Ricardo had insisted was impossible.

In Recent Economic Changes, it was Wells’s task to trace the roots of the ongoing crisis, and in painstaking detail, he lays the blame at the feet of price-destroying revolutions in the productivity of labor which had the effect of glutting markets and eliminating profits.While Ricardo would have predicted a higher rate of profit to accompany rising productivity, assuming the gains included industries producing goods for worker consumption, in fact profits evaporated because the high cost of plant and equipment made it cheaper to continue running them with no profit, or even at a loss, than to shut down entirely and risk losing the entire investment.[26]

Wells begins by stating that:

When the historian of the future writes the history of the nineteenth century he will doubtless assign to the period embraced by the life of the generation terminating in 1885, a place of importance, considered in its relations to the interests of humanity, second to but very few, and perhaps to none, of the many similar epochs of time in any of the centuries that have preceded it; inasmuch as all economists who have specially studied this matter are substantially agreed that, within the period named, man in general has attained such a greater control over the forces of Nature, and has so compassed their use, that he has been able to do far more work in a given time, produce far more product, measured by quantity in ratio to a given amount of labor, and reduce the effort necessary to insure a comfortable subsistence in a far greater measure than it was possible for him to accomplish twenty or thirty years anterior to the time of the present writing (1889) (Wells 1889, 27).

Wells then takes the reader on a grand tour of the productivity revolution of the preceding twenty-five years, in which the major lines of industry featured productivity gains ranging from 200–500 percent (ibid, 28).Some of the highlights include a 250 percent increase in the productivity of steel manufacture over a ten-year period (ibid, 43), a 500 percent increase in the productivity of shoe-making (ibid, 28), and such a revolution in the technology in place in US cotton mills that “one operative, working one year, in the best mills of the United States, will now…supply the annual wants of 1600 fully-clothed Chinese, or 3000 partially-clothed East Indians” (ibid, 50).Ricardo might have been particularly interested in puzzling over the theoretical implications of the fact that the revolution in agriculture had been so great that after all the labor “embodied” in the bread of urban workers had been accounted for, including that required for fuel and transportation, “our final result is that ten men working one year serve bread to one thousand” (Atkinson, cited in ibid, 58).

The problem was that this was bad for business.It wasn’t the revolutions in labor productivity per se.Malthus had argued that the production of all commodities could be entirely automated, leaving no labor content whatsoever, and that prices would remain the same so long as the supply coming to market, and the quantity of labor given in exchange for it, remained unchanged (Malthus 1968, 72).Wells similarly argued that the problem was that production wasn’t being sufficiently “restricted or suspended” in the face of these quantum leaps in the human capacity to produce Adam Smith’s “necessaries and conveniences of life,” with the result being a rate of production which “far exceeds any concurrent market demand” (ibid, 73; Smith 1948, 315).Wells argued that capital had spent the greater part of the nineteenth century “fully equipping the civilized countries of the world” with the fundamental economic infrastructure of ports, railways, merchant fleets, and telegraph lines (Wells, 1889, 63–64).Now, with “the equipment having at last been made ready, the work of using it for production has in turn begun, and has been prosecuted so efficiently, that the world has within recent years, and for the first time, become saturated, as it were, under existing conditions for use and consumption, with the results of these modern improvements” (ibid, 63).

The aforementioned cost of shuttering plant and equipment provided the perverse incentive to continue production, and the financial means of the large capitalists producing goods for the market meant that bankruptcy no longer played its vital role in ensuring that capital remained in proper proportion to the means of profitably employing it (ibid, 73).Now commonly organized as joint-stock companies, and no longer dependent on the financial resources of a single individual or small group, it was not out of the ordinary for such firms to make “no profit” and pay “no dividends for years, and yet continue active operations” (ibid).The result was that “since 1873,” “the prices of nearly all the great staple commodities of commerce and consumption have declined…in manner altogether without precedent in all former commercial history” (ibid, 78).[27] Capitalists complained that they were tired of “working for the public” (Sklar 1987, 56), i.e., producing without a profit, and that the current conditions of “large output” and “keen competition” “threatens our property with virtual confiscation” (Wells 1889, 79).

The tension these capitalists felt between their interests and those of the “public” was none other than that between “wealth,” measured in terms of ease of access to the “necessaries and conveniences of life,” and “value,” which required relative scarcity for its maintenance and preservation.For despite the “unprecedented disturbance and depression of trade, commerce, and industry” of which Wells complained, if measured in terms of quantities of goods bought, sold, and consumed, particularly by the working class, business was booming.“In fact,” said Wells, “the volume of trade, or the quantities of commodities produced, moved and exchanged, has never been so great in the history of the world as during the past ten or fifteen years; and the so-called depression of trade during this time has been mainly due to a reduction of profits, to such an extent that, as the expression goes, ‘it has not paid to do business’ ” (ibid, 206).Prices and profits had fallen catastrophically, said Wells, but wages, in general, had not, with the result that in this period of “unprecedented” depression, “the purchasing power of wages has risen, and this has given to the wage-earning class a greater command over the necessaries and comforts of life” (ibid, 86).

Nowhere was this tension more in evidence than in the matter of the food supply of this apparently coddled “public.”An upturn in economic conditions beginning in 1878 had led many observers to pronounce an end to the crisis which had commenced five years earlier, but time would reveal that this was “only an ‘interruption,’ occasioned by extraordinary causes” (ibid, 6).The “extraordinary causes” Wells referred to were a series of failures “of the cereal crops of Europe and most other countries of the world, with the exception of the United States,” “a failure for which, in respect to duration and extent, there had been no parallel in four centuries,” resulting in “a remarkable demand on the latter country for all the food-products it could supply, at extraordinary prices” (ibid).The skyrocketing prices not only “went far to alleviate the distress of [even] the foreign agriculturalist,” but the receipts of American farmers were spent largely on the products of industry, domestic and foreign, which resulted in a “boom,” temporarily ending the slump (ibid, 7).

Predictably, the high prices stimulated “the occupation and utilization of new and immense areas of cheap and fertile wheat-growing land” in the United States and around the world (ibid, 89).These areas continued producing despite the recovery of areas hit by crop failure, with the result that wheat prices soon crashed to levels far below their previously depressed state (ibid, 90).Wells notes the tension between price and plenty this way:

In short, it would seem as if the world in general, for the first time in its history, has now good and sufficient reasons for feeling free from all apprehensions of a scarcity or dearness of bread.But, while from a strictly humanitarian point of view this is certainly a matter for congratulation, the results, viewed from the standpoint of the interests involved, which embraces a large part of the world’s population, appear widely different.The effect of the extensive fall in prices of agricultural products during the last decade has been most disastrous to the agricultural interests and population of Europe.It has reduced farming in England and in most of the states of the Continent to the lowest stage of vitality; and, by reason of the complaints of their agriculturalists, the customs duties of many countries have been largely increased, and the conditions of consumers modified.In France, the position has been taken…that the only possible means of salvation…will be for France, Germany, Austria and Italy to sink all political antipathies and jealousies and form an international customs union to exclude all food-products from Russia, Australia, and America (ibid, 177).

In 1888, when expectations of crop failure in the United States, Australia, Canada, and the Argentine Republic were realized, but the existence of such enormous reserve stocks of grain prevented prices from rising, Bradstreet’s Journal found the turn of events “disheartening” (ibid, 175).